NIGERIA: EMERGENCY BILL TARGETS NON-OIL REVENUE BOOST

In a bid to address Nigeria’s economic challenges, the Federal Government has announced plans to introduce an emergency economic bill. This legislation aims to significantly increase revenue generated outside the oil sector.

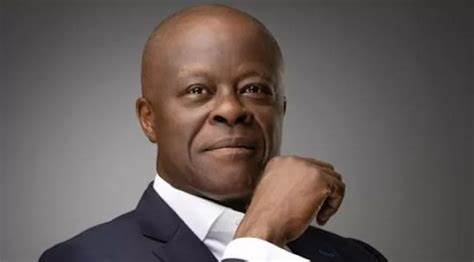

The initiative was unveiled by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, during a presentation at the Lagos Business School (LBS) Breakfast Club. Edun explained that the government is “finalizing an Emergency Economic Bill which will, in part, enhance non-oil revenue.”

The bill will focus on several key areas to achieve this goal. These include:

- Expanding the tax base: This likely refers to identifying and bringing more individuals and businesses under the tax umbrella.

- Improving tax compliance: This suggests stricter enforcement mechanisms to ensure existing taxpayers fulfill their obligations.

- Automating excise tax: This could involve implementing digital systems for collecting taxes on specific goods like tobacco or alcohol.

- Reviewing tax exemptions and duty waivers: The government will likely analyze existing exemptions to determine if they are still necessary and if they represent a significant loss of revenue (estimated at 1% of GDP).

- Recalibrating incentive structures: This could involve revising existing tax breaks and subsidies to ensure they are targeted effectively and don’t create unintended consequences.

By implementing these measures, the government hopes to diversify its revenue streams and lessen its dependence on oil exports, which are susceptible to global price fluctuations.

Source: Nariametrics

Read Also:

TAIWO OYEDELE COMMITTEE PROPOSES VAT INCREASES TO COMPENSATE FOR TAX REFORMS