- Acess Bank PLC

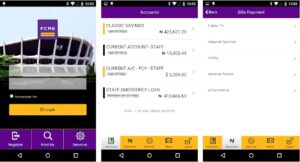

- FCMB

- Fidelity Banking

- Premier Bank

- GTBANK

- Stanbic IBTC

- Sterling Financial

- United Bank of Africa (UBA)

- Wema Financial

- Zenith Banking

The landscape of personal finance has evolved with the integration of mobile banking into the daily routines of numerous consumers. A recent examination by Mastercard, a global leader in payments and technology, reveals that a substantial ninety-one percent (91%) of Nigerians utilize digital channels, such as banking applications and websites, for their financial transactions.

The magnetic appeal lies in the convenience that mobile banking provides. Given that consumers carry their smartphones virtually everywhere, a mobile banking app serves as a compact solution, enabling them to efficiently manage a spectrum of financial activities at their convenience. Essentially, it transforms your smartphone into a portable bank.

Beyond the realm of mere convenience, mobile banking steps in as a valuable tool for individuals uneasy about their savings. It furnishes users with practical features for tracking expenses, establishing savings targets, and upholding financial stability.

Moreover, mobile banking broadens financial accessibility for those devoid of proximity to a physical branch, catering to individuals in need of swift loan facilities.

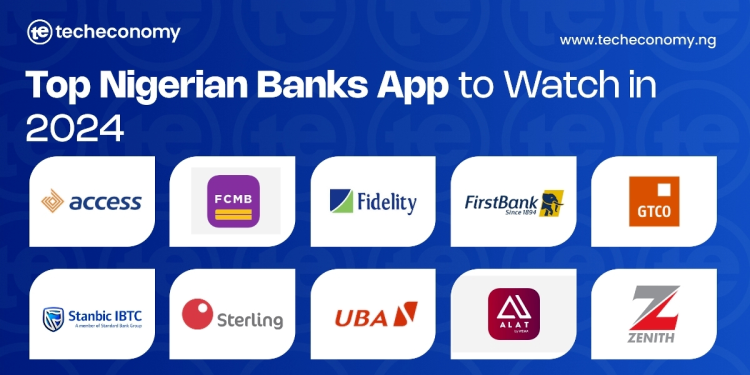

In this piece, Techeconomy meticulously assesses ten (10) Nigerian banking apps that have seized our attention in 2024.

Let’s delve in!

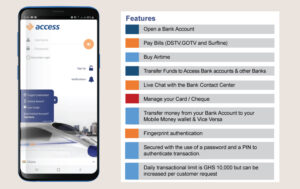

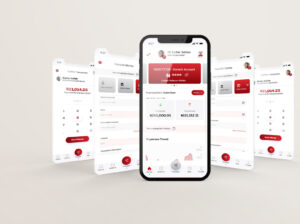

1: Access bank PLC

Number of Downloads on Play Store: 5,000,000+

Play Store Installations: Surpassing 1 million downloads

User Rating: Rated at 3.9 out of 5

User Feedback:

Wema Bank app users have cited occasional challenges in logging in, with suggestions for enhancements in the app’s speed.

Loan Offerings:

Wema Bank provides a diverse range of loan options through its app, ensuring users have convenient access to credit facilities. The bank targets niche markets such as young professionals and SMEs, offering innovative loan products like the ALAT Salary Top-up, featuring flexible repayment options and competitive interest rates.

UI/UX:

The user interface is visually appealing, complemented by enhanced app speed for an enriched user experience.

Special Features:

Wema Bank allows users to customize their account profiles within the app, delivering a personalized banking experience. Users also appreciate the efficiency of the app in facilitating quick fund transfers. The bank maintains a strong focus on digital banking and financial technology, introducing innovative products like ALAT, the digital bank, and employing youth-centric marketing and branding strategies.

Security Measures:

Wema Bank places a high priority on security, implementing multi-layered authentication processes and encryption protocols to safeguard user information. The bank commits substantial investments in cybersecurity measures, conducting regular security audits and penetration testing.

10: Zenith Bank

Image Source: Google Search Engine

Image Source: Google Search Engine

Play Store Installations: Exceeding 5 million downloads

User Rating: Rated at 3.3 out of 5

User Feedback: Users have reported issues with beneficiary lists, reduced transfer limits, and challenges in the login process. The Zenith Bank Mobile App also faces criticism for poor customer service experiences, inconsistent app performance, and strict account maintenance fees.

Loan Offerings: Zenith Bank offers a spectrum of personal, business, and mortgage loans, featuring competitive interest rates for prime customers alongside stringent loan approval processes.

UI/UX: The recent UI/UX update received mixed reviews, with users appreciating innovation but calling for improvements in functional clarity.

Special Features: Innovative features, such as sending money to nearby users, contribute positively to the user experience. The app also features account aggregation, instant transfers, airtime purchase, a loyalty points program, and QR code payments.

Security Measures: Zenith Bank places strong emphasis on cybersecurity, implementing measures to protect users’ data against fraudulent activities. The bank has established a robust security framework to enhance user protection.

In conclusion, users of Nigerian banking apps encounter common challenges across the institutions reviewed. These issues range from beneficiary lists, reduced transfer limits, and challenges in the login process to poor customer service experiences, inconsistent app performance, and strict account maintenance fees.

Zenith, UBA, GTCO, FirstBank, and Access Bank all boast over 5 million app downloads on the Google Play Store as of the time of this review.

Conversely, Wema Bank (ALAT), Sterling, Stanbic IBTC Bank, Fidelity, and FCMB account for 1 million-plus downloads.

From a UX/UI perspective, Nigerian banks are generally well-received, with none of them receiving less than a 3.2 rating out of 5.

In this context, the Access Bank mobile app emerges as the highest-rated with a 4.5 out of 5.

Which banking app are you using?

What has been your experience?

News Source: Techeconomy

Image Source: Google Search Engine

Image Source: Google Search Engine Image source: Google Search Engine

Image source: Google Search Engine  Image Source: Google Search Engine

Image Source: Google Search Engine Image Source: Google Search Engine

Image Source: Google Search Engine  Image Source: Google Search Engine

Image Source: Google Search Engine  Image Source: Google Search Engine

Image Source: Google Search Engine  Image Source: Google Search Engine

Image Source: Google Search Engine  Image source: Google Search Engine

Image source: Google Search Engine